Economist Warns of Potential Fiscal Time Bomb in 2026 Draft State Budget, from Tempo.com

By Adil Al Hasan for Tempo.co, August 15, 2025

Syafruddin Karimi, senior economics lecturer at Andalas University in West Sumatra’s capital Padang, called on the Ministry of Finance to ensure government expenditure is productive, and a strong tax base in the 2026 Draft State Budget (RAPBN). He also urged the country’s central bank Bank Indonesia to maintain the stability of the rupiah exchange rate, liquidity, and inflation.

Syafruddin said Indonesia’s challenges have become increasingly complex after President Donald Trump reverted to protectionism with 19 percent tariffs on many imported products.

“The government also needs to strengthen fiscal incentives and export diversification strategies to maintain competitiveness. Without synergy, the government’s budget will be vulnerable to external shocks,” he said in a written statement released Friday, August 15, 2025.

According to Syafruddin, the [US] tariff policy is not just a trade instrument, but also a political-economic weapon that will shake up the global supply chain. For Indonesia, he said, the impact could include weakening exports, a depreciating rupiah, and rising inflation.

Syafruddin also said the 2026 Draft State Budget could face severe pressure if macroeconomic assumptions are disrupted. “The business world will be forced to adapt more quickly, seek alternative markets, and increase import substitution,” he said.

At the same time, Syafruddin also called on President Prabowo Subianto to view the 2026 State Budget as more than just an administrative document. He believed the State Budget is Indonesia’s economic roadmap.

In the Draft 2026 State Budget, Syafruddin said there are two directions: spending expansion to strengthen growth, and deficit discipline to maintain fiscal sustainability.

Syafruddin stated that spending optimism always comes hand in hand with the risk of a deficit. The 2026 Draft State Budget estimates a deficit of Rp 706 trillion. Although the figure is large, as a percentage of GDP it is lower than in 2025, which came in at 2.78 percent.

“The key is spending effectiveness. If public spending is truly productive, every rupiah will generate higher economic growth than the fiscal burden it bears,” he said.

President Prabowo Subianto presented the Financial Note for the 2026 Draft State Budget Friday, August 15, 2025, at the People’s Representative Council in the Senayan district of Jakarta.

The Draft State Budget targets a growth rate of 5.2 to 5.8 percent, with a deficit maintained at 2.53 percent of GDP. According to Syafruddin, the combination of spending expansion, and fiscal discipline reflects a middle-ground strategy, namely, pursuing growth without sacrificing sustainability.

According to Syafruddin, the basic macroeconomic assumptions of the 2026 draft government budge demonstrate the government’s efforts to maintain optimism amid global uncertainty. Inflation is projected to remain under control at 1.5 to 3.5 percent, the rupiah exchange rate is pegged at Rp 16,500 to 16,900 per US dollar, and oil prices are within a realistic range of US$60 to 80 per barrel. Based on this foundation, the government is targeting state revenues of Rp 3,094 to 3,114 trillion, up from the 2025 budget prognosis of Rp 2,865.5 trillion.

Meanwhile, government spending is slated to be Rp 3,800 to 3,820 trillion, a significant increase from Rp 3,527.5 trillion in 2025. The increased spending is directed toward infrastructure, food security, energy, and defense.

According to Syafruddin, this strategy aligns with the Keynesian view that public spending can create a multiplier effect for consumption and investment. “Therefore, the 2026 draft budget aims to ensure spending is not just a figure, but also a tool for accelerating growth,” he said.

However, Syafruddin said, the real challenge lies not in the design, but in the execution. The government is being asked to generate growth in the midst of tax loopholes, President Trump’s tariffs, and global uncertainty.

Syafruddin added that the Prabowo-era draft budget demonstrated commendable optimism, namely high growth, low inflation, a stable rupiah, and a deficit under control. “But this optimism will only be meaningful if it is accompanied by realism in its implementation. The specter of Trump’s tariffs is a reminder that the outside world can quickly shake up domestic macroeconomic assumptions,” he said.

According to him, the 2026 budget is a test of balance. If revenue, spending, and growth move in harmony, Indonesia can confidently capitalize on global momentum. “However, if spending is unproductive, and revenue weakens, the deficit could turn into a time bomb,” said Syafruddin.

Adil Al Hasan joined Tempo in 2023 and covers economic issues daily. He is a fellow of several programs including AJI Indonesia’s Data Journalism.

This post is based on https://www.tempo.co/ekonomi/ekonom-ingatkan-soal-bom-waktu-beban-fiskal-dalam-rapbn-2026–2059177.

In earlier news…

A Trader’s Guide to President Prabowo’s First Indonesian Budget, Bloomberg

By Prima Wirayani and Grace Sihombing, August 14, 2025

As Indonesian President Prabowo Subianto presents his 2026 budget to parliament Friday, the market will be watching how he intends to promote his populist agenda while maintaining fiscal discipline. Read the full piece at https://www.bloomberg.com/news/articles/2025-08-14/a-trader-s-guide-to-president-prabowo-s-first-indonesian-budget.

***

Emerging Markets’ Fragile Five Are Breaking Bad Again

Bloomberg Opinion By Shuli Ren, Bloomberg Columnist, March 21, 2025

Investors are looking beyond the US. But Indonesia and Turkey are not behaving well.

It’s not a zero-sum game. Even as global investors spooked by Donald Trump’s unpredictable policies are trimming positions in US stocks, it doesn’t necessarily mean they will plow into emerging markets. Developing nations have to earn foreigners’ trust first.

Unfortunately, some of the biggest are shooting themselves in the foot…

(Excerpts)

Indonesia and Turkey, two members of the Fragile Five …, are back in the limelight…

On Tuesday, the Jakarta Composite Index witnessed its steepest intraday decline in more than a decade over speculation that the nation’s well-respected finance minister had decided to resign…

…Indonesian President Prabowo Subianto’s ambitious plan to create a new sovereign wealth fund, modeled on Singapore’s investment arm Temasek Holdings Pte, has alarmed investors. Jakarta already has a $20 billion wealth fund. But Prabowo wanted more.

The new one, called Danantara Indonesia, is a completely different animal. It will eventually manage $900 billion and house state-owned enterprises, including oil and natural gas producer Pertamina, PT Telkom Indonesia and PT Bank Mandiri. Bank Mandiri lost about one-third of its market value since Danantara was launched on Feb. 24.

Investors now fear Indonesia is losing the fiscal discipline established during former President Joko Widodo’s years. The law limits the government’s budget deficit to 3% of gross domestic product, but that was not enough for Prabowo’s big-ticket plans and his ambitious 8% growth target. Danantara could be a backdoor channel to borrow off balance sheet and spend. Analysts worry that Indonesians will be so spooked that they pull their deposits out of the three big SOE banks controlled by Danantara…

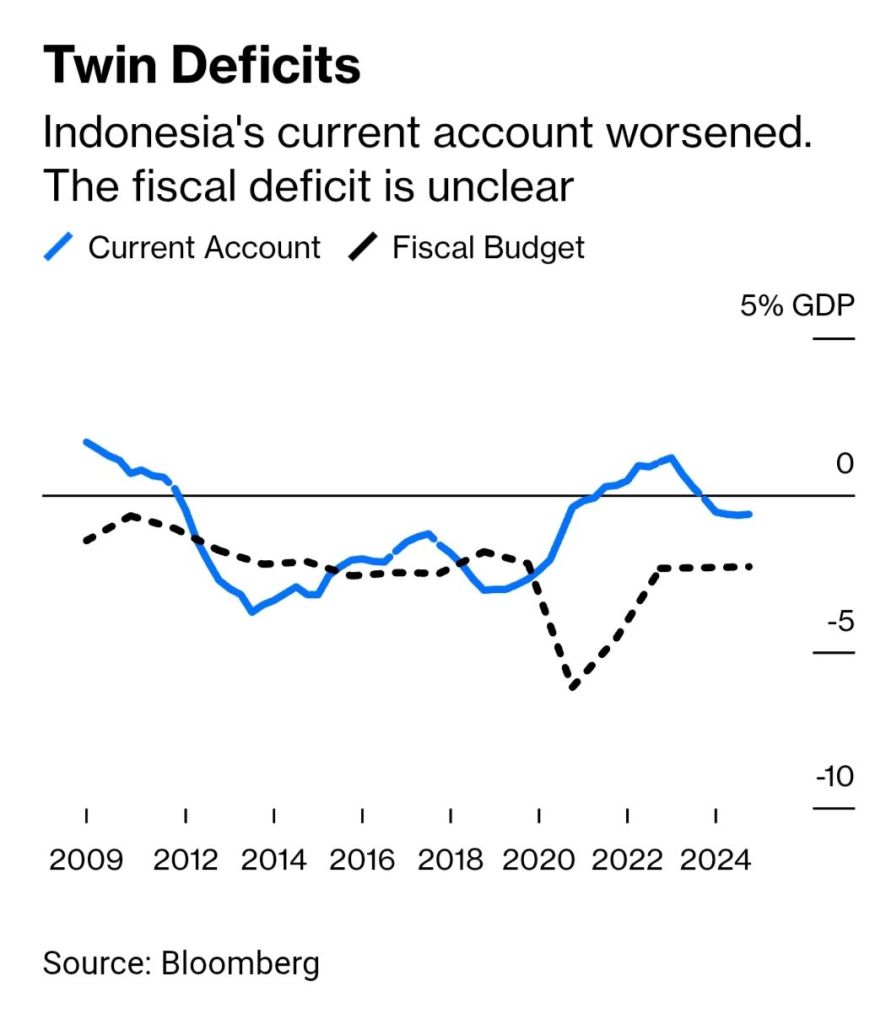

…But the Fragile Five’s fundamental weaknesses have not completely given away. Indonesia’s current account flipped back into the red last year, while the true level of the fiscal deficit has become a big mystery. …

…To attract overseas capital, Indonesia and Turkey need to lessen — not to amplify — their fragility.

Baca selengkapnya https://www.bloomberg.com/opinion/articles/2025-03-20/turkey-indonesia-emerging-markets-fragile-five-are-breaking-bad-again.

In related news:

- https://www.bloomberg.com/news/articles/2025-10-17/indonesia-adds-1-8-billion-of-cash-handouts-in-latest-stimulus

- https://www.instagram.com/p/DNeiWi9M63r/

- https://www.bloomberg.com/news/articles/2025-08-19/prabowo-s-populist-budget-raises-doubts-over-revenue-goals

- https://nasional.kompas.com/read/2025/08/15/16534741/prabowo-lanjutkan-efisiensi-anggaran-tahun-2026

- https://storiesfromindonesia.com/2025/05/22/economic-outlook-budget-cuts-spark-negative-reactions-across-indonesia/

- https://www.bloomberg.com/news/articles/2025-08-15/prabowo-targets-narrower-deficit-while-touting-social-spending

- https://www.tempo.co/ekonomi/ekonom-ingatkan-soal-bom-waktu-beban-fiskal-dalam-rapbn-2026–2059177

- https://www.bloomberg.com/news/articles/2025-06-25/indonesia-on-track-to-keep-modest-budget-deficit-indrawati-says

- https://www.bloomberg.com/news/articles/2025-05-28/dalio-won-t-join-indonesia-fund-as-adviser-in-blow-to-prabowo

- https://www.bloomberg.com/news/articles/2025-05-25/china-indonesia-sovereign-wealth-funds-boost-investment-ties

- Indonesia to launch economic stimulus to boost consumption, Reuters, May 24, 2025

- https://www.bloomberg.com/news/articles/2026-01-23/idr-usd-why-is-indonesia-rupiah-so-weak-how-is-its-economy-affected

Leave a Reply